amazon flex taxes canada

Youll need to record the number of miles you do keeping a detailed log of where you have travelled and then claim the set amount by HMRC. You may be.

How To Do Taxes For Amazon Flex Youtube

5 percent GST x value of goods duty paid.

. From there select the Tax Document library. They treat you as a disposable employee and you have to abide by their policies even though you are an independent contractor. Also hurdlr connects you within the proper tax bracket of whichever state or province you working out of.

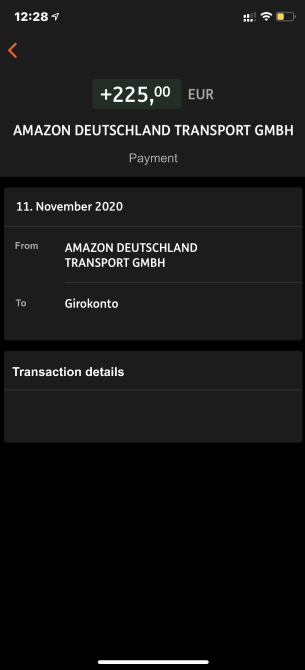

An order fulfilled from an ontario fulfilment centre where the tax rate is 13 hst rate may vary based on fc location with an fba pick pack fee of 700 and shipping chargeback fee of 600 fee application and amounts will vary per order we will collect and remit 169 sales tax to comply with federal and provincial law calculated as 13. Driving for Amazon flex can be a good way to earn supplemental income. Amazon Flex Canada Make CAD 22-27hour delivering packages with Amazon.

TurboTax Live tax prep. Claiming for a Car on Amazon Flex Taxes. Most imported goods are subject to GST at a rate of 5 percent.

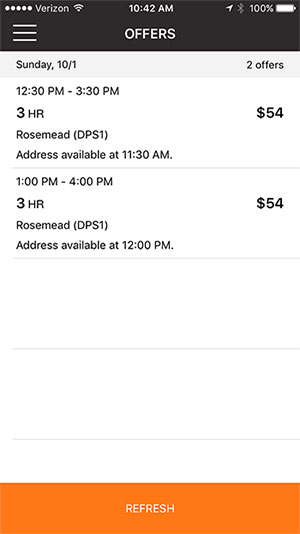

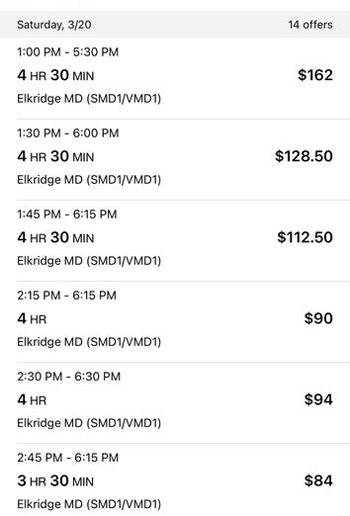

The rates are currently 45p for the first 10000 miles of driving. Youll also pay income taxes according to your tax bracket. With Amazon Flex you work only when you want to.

But if you havent heard from them about your 1099-K you can find the form by following these simple steps. They come to 153 for you compared to the 765 paid by traditional employees. Were here to help.

Be your own boss. Ad We know how valuable your time is. We would like to show you a description here but the site wont allow us.

Knowing your tax write offs can be a good way to keep that income in your pocket. First log in to your Amazon Seller Central account. If duty is applicable duty is added to the value of the goods and the GST will apply on the duty-paid value of the shipment ie.

Ontario 13 New Brunswick 15 Newfoundland 15 Nova Scotia 15 Prince Edward Island 15 When you make a sale on Amazonca the sale may be subject to GST HST or Provincial sales tax depending on whether you and the product you sell meet federal or provincial sales tax requirements. It would be wise to open either a sole proprietorship or Ltd business once you connect. If this is your first year as a Flex driver that 153 can land you with a tax bill much heavier than youre used to seeing.

Not finding what you need. Its almost time to file your taxes. Amazon Flex drivers are independent contractors.

Unlike a W-2 employee Amazon doesnt pay half of your self-employment taxes. How TurboTax Live Works. So you get social security credit for it when you retire.

The SE tax is already included in your tax due or reduced your refund. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the. Amazon Flex - US.

Next click on the Reports menu. When people talk about self-employment tax theyre referring to this doubled payment of Medicare and Social Security taxes. Most people pay 153 in self-employment tax.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Your schedule relies on their demand sometimes you have work sometimes you dont After you calculate all your expenses gas car wear taxes you are left with minimum wage and zero benefits. Make more time for whatever drives you.

Who Pays All The Taxes In Canada. Premier investment. Those earning the highest incomes pay 28 percent of their incomeIn total taxes amount to 8 percent of earningsThe income received by this group is 8 percentThe average household paying 3909 euros in tax is in the top 10 percentTaxes make up 6 percent of the income.

And finally downloadprint your 1099-K. All online tax preparation software. Get started now to reserve blocks in advance or pick them daily based on your schedule.

Gig Economy Masters Course. It automatically tracks milage and allows you to separate amazon flex miles business from personal in my case kilometers cause Im in Canada. TurboTax Live Tax Expert Products.

Increase Your Earnings. If you are using your own car for Amazon then you can choose to claim an amount for the number of miles you drive. Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals.

That means you have to pay self-employment tax. It is on the 1040 Schedule 2 line 4 which goes to 1040 line 15. Military tax filing discount.

Saskatchewan 5 GST 6 PST HST. Most drivers earn 18-25 an hour. Free Edition tax filing.

This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. Deluxe to maximize tax deductions. Self-employment taxes include Social Security and Medicare taxes.

I Was An Amazon Delivery Driver What It S Like To Work In The Tech Giant S Citizen Package Brigade Geekwire

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Does Amazon Flex Pay For Gas Mileage Rules How To Save Money

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Does Amazon Flex Pay For Gas Mileage Rules How To Save Money

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Make Money On Amazon In Canada 12 Practical Ways 2022

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Does Amazon Flex Pay For Gas Mileage Rules How To Save Money

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazonflex Amazon Flex Canada Pros Youtube

Amazon Flex Filing Your Taxes Youtube

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver